Differential costs are cma adapted – Differential costs, a cornerstone of cost-benefit analysis and capital budgeting, play a pivotal role in strategic decision-making. This article explores the concept of differential costs, their significance in CMA adaptation, and provides a comprehensive guide to their calculation and application.

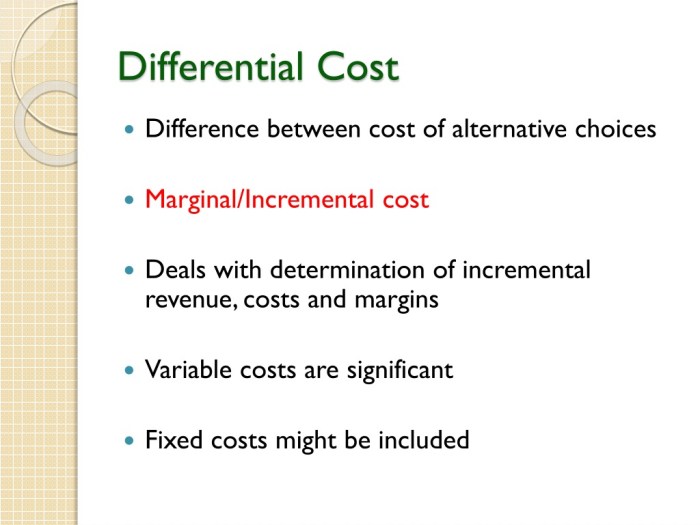

In the realm of accounting and finance, differential costs are incremental costs or savings that arise from a specific decision or action. Understanding these costs is crucial for evaluating the potential benefits and risks associated with various alternatives.

1. Introduction to Differential Costs

Differential costs are incremental costs or benefits that arise from a specific decision or change in a business operation. They are the difference in costs between two alternative courses of action and are crucial for making informed decisions in various areas of business management.

Examples of differential costs include:

- Additional raw materials required for a new product line

- Increased labor costs associated with overtime production

- Savings on rent if a smaller office is leased

- Opportunity cost of using existing resources for a different purpose

Understanding differential costs is essential because they help businesses identify the potential financial impact of their decisions. By comparing the incremental costs and benefits of different options, managers can make informed choices that maximize profitability and minimize risks.

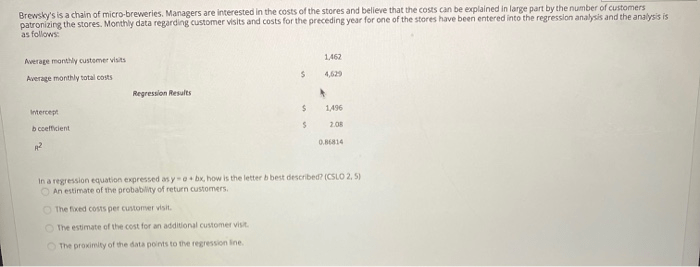

2. Differential Costs and CMA Adaptation

Differential costs play a vital role in cost-benefit analysis (CBA), a technique used to evaluate the financial feasibility of a project or investment. By incorporating differential costs into CBA, managers can determine the net present value (NPV) or internal rate of return (IRR) of a project, helping them make sound investment decisions.

In capital budgeting, differential costs are used to assess the incremental cash flows associated with different investment proposals. This information is critical for selecting projects that align with the company’s strategic objectives and maximize shareholder value.

Applying differential costs in practice can be challenging due to:

- Difficulty in accurately estimating future costs and benefits

- Potential biases and assumptions in the analysis

- Lack of historical data or comparable projects

3. Methods for Calculating Differential Costs

The calculation of differential costs involves a step-by-step process:

- Identify the two alternative courses of action being compared

- Determine the relevant costs and benefits for each alternative

- Subtract the costs and benefits of the existing option from those of the new option

- The resulting difference represents the differential costs

There are various methods used to calculate differential costs, including:

- Incremental analysis

- Activity-based costing (ABC)

- Contribution margin analysis

Each method has its strengths and weaknesses, and the choice of method depends on the specific situation and data availability.

4. Examples of Differential Cost Analysis: Differential Costs Are Cma Adapted

The following table provides examples of differential cost analysis in various industries:

| Industry | Cost Item | Differential Cost | Impact on Decision-Making |

|---|---|---|---|

| Manufacturing | Raw materials | $100,000 | Increase in production capacity |

| Retail | Marketing campaign | $50,000 | Increased sales revenue |

| Healthcare | New medical equipment | $200,000 | Improved patient outcomes |

| Education | Online learning platform | $30,000 | Expansion of student reach |

These examples demonstrate how differential cost analysis can provide valuable insights for decision-making in different business contexts.

5. Best Practices for Differential Cost Analysis

To ensure accuracy and reliability in differential cost analysis, it is crucial to follow best practices:

- Use appropriate assumptions and data

- Consider all relevant costs and benefits

- Conduct sensitivity analysis to assess the impact of changes in assumptions

- Document the analysis process and findings clearly

- Seek professional advice if necessary

By adhering to these best practices, businesses can maximize the effectiveness of differential cost analysis in their decision-making processes.

6. Limitations of Differential Cost Analysis

While differential cost analysis is a powerful tool, it has certain limitations:

- It assumes that all other factors remain constant, which may not always be the case

- It may not be suitable for long-term or complex decisions

- It relies on accurate data, which may not always be available

In situations where differential cost analysis is not appropriate, alternative methods such as break-even analysis or scenario planning may be more suitable.

General Inquiries

What are the key principles of differential cost analysis?

Differential cost analysis involves identifying and comparing the incremental costs and benefits associated with alternative decisions, considering only those costs that change as a result of the decision.

How are differential costs used in CMA adaptation?

Differential costs play a crucial role in CMA adaptation, particularly in capital budgeting decisions. By incorporating differential costs into their analysis, CMAs can assess the potential profitability and viability of investment projects.

What are the challenges of applying differential costs in practice?

Applying differential costs in practice can be challenging due to factors such as the difficulty in accurately estimating future costs and the need to consider both quantitative and qualitative factors in decision-making.