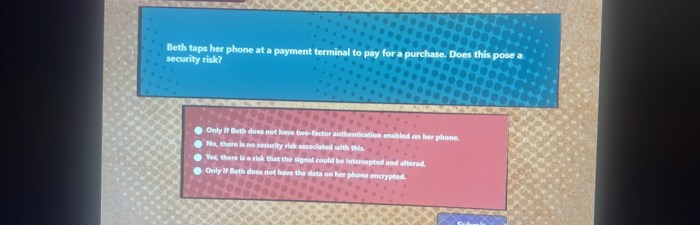

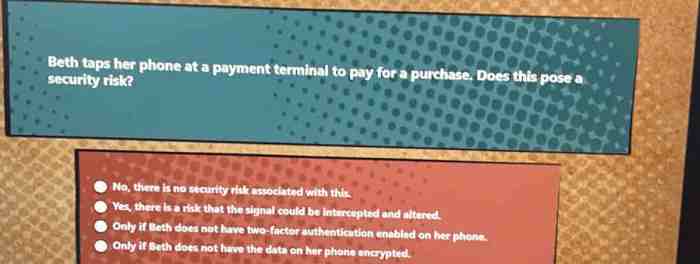

Beth taps her phone at a payment terminal cyber awareness – in this thought-provoking exploration, we delve into the potential security risks associated with using mobile devices for financial transactions, unraveling the implications of Beth’s actions and uncovering best practices for ensuring mobile payment security.

As the digital landscape continues to evolve, understanding the nuances of cyber awareness becomes paramount. Beth’s actions serve as a cautionary tale, highlighting the importance of vigilance when conducting financial transactions in the digital realm.

Understanding Cyber Awareness

Cyber awareness refers to the understanding of cyber threats and the ability to protect oneself from them. It is essential for individuals using mobile devices for financial transactions, as mobile devices can be vulnerable to cyberattacks.

Risks of Mobile Payment Transactions

- Unsecured public Wi-Fi networks can allow attackers to intercept data.

- Malicious apps can steal sensitive information or perform unauthorized transactions.

- Unpatched software vulnerabilities can provide entry points for attackers.

Beth’s Actions and Their Implications

Beth’s actions of tapping her phone at a public payment terminal without checking for security measures posed several potential risks:

Security Risks

- Unsecured terminals could allow malware to be installed on her phone.

- Keyloggers or skimmers could capture her PIN or payment details.

- Fraudulent charges could be made to her account.

Best Practices for Mobile Payment Security

To enhance mobile payment security, individuals should follow these best practices:

- Use strong passwords and enable multi-factor authentication.

- Only download apps from trusted sources.

- Keep software and apps up to date.

- Be cautious of using public Wi-Fi networks.

- Use secure mobile payment apps with encryption and tokenization.

Education and Awareness Initiatives: Beth Taps Her Phone At A Payment Terminal Cyber Awareness

Education and awareness campaigns play a crucial role in promoting cyber safety. Effective campaigns target mobile payment security by:

- Educating users about the risks associated with mobile payments.

- Providing guidance on best practices for secure mobile payment usage.

- Raising awareness about the importance of reporting suspicious activity.

Technical Safeguards and Countermeasures

Technical safeguards and countermeasures can protect mobile devices from cyber threats:

Safeguards, Beth taps her phone at a payment terminal cyber awareness

- Secure apps with built-in security features.

- Software updates with security patches.

- Encryption and tokenization to protect sensitive data.

Countermeasures

- Anti-malware software to detect and remove malicious apps.

- Virtual private networks (VPNs) to encrypt internet traffic.

- Mobile device management (MDM) solutions to remotely manage and secure devices.

Case Study: Lessons Learned

A recent cyber incident involving mobile payment fraud highlighted the following lessons:

- Importance of using strong passwords and multi-factor authentication.

- Vulnerability of unsecured public Wi-Fi networks.

- Need for prompt reporting of suspicious activity to prevent further damage.

FAQ Overview

What are the key risks associated with using mobile devices for financial transactions?

Mobile devices may be vulnerable to malware, phishing attacks, and unauthorized access, potentially compromising financial data and leading to fraudulent transactions.

What are some best practices for using mobile devices for secure payments?

Use strong passwords, enable multi-factor authentication, keep software updated, and only download apps from trusted sources to minimize security risks.

How can education and awareness campaigns contribute to mobile payment security?

Campaigns can raise awareness about cyber threats, promote responsible practices, and empower individuals to protect their financial information.